1031 Exchanges into DST Investments

- Looking to defer capital gains taxes?

- Wanting to move from active property management to passive income?

- Seeking monthly income?

- Wanting to simplify estate planning?

- Wanting access to diversified & institutional-quality real estate investments?

- Looking to defer capital gains taxes?

- Wanting to move from active property management to passive income?

- Seeking monthly income?

- Wanting to simplify estate planning?

- Wanting access to diversified & institutional-quality real estate investments?

Understanding DST and 1031 Exchange: The Basics

- Why a 1031 exchange transaction?

- Defer Your Capital-Gains Taxes!

- Do you own investment property?

- Are you exploring Your tax-deferment options in a sale?

Introduction to DST

The Benefits

- Monthly income: you will receive monthly income from the dst investments. Many of them have typically paid 3-6% annually. Once the trust sells the underlying asset, you receive the proceeds of the sale, per your shares. The goal of the dst sponsors is to realize a significant profit on the sale. Most dsts have a life cycle of 5-7 years, some going for as long as 10 years.

- Exchange again: at the end of a dst’s life cycle, you can employ the 1031 exchange again, to reinvest in other dsts, or buy more real estate, or take your proceeds and pay capital gains taxes on them.

- Estate planning: if you pass away, your heirs receive the shares you designate, without the potential arguments over the disposition of real estate. Additionally, they receive their shares at a step-up in basis, permanently removing the capital gains taxes that had been deferred up to that point.

A delaware statutory trust (DST) is a legal entity that allows investors to own a fraction of a large, institutional-quality real estate property. This form of investment offers potential for income and appreciation while qualifying for a 1031 exchange to defer capital gains taxes.

What is an Accredited Investor?

The Criteria

To qualify as an accredited investor, an individual must meet at least one of the following conditions:

Have an annual income exceeding $200,000 (or $300,000 together with a spouse) for the last two years, with the expectation of earning the same or higher income in the current year.

Possess a net worth exceeding $1 million, either individually or together with a spouse, excluding the value of the primary residence.

We will be verifying accredited investor status when onboarding a client. No current DST offering info will be provided to an unverified client.

An accredited investor is an individual recognized by securities laws to have the financial acumen and capacity to undertake risks associated with certain investment opportunities not available to the general public. This designation allows access to a wider range of investment vehicles, including private placements, hedge funds, venture capital, and other sophisticated investment offerings.

Why Accredited Investor Status Matters?

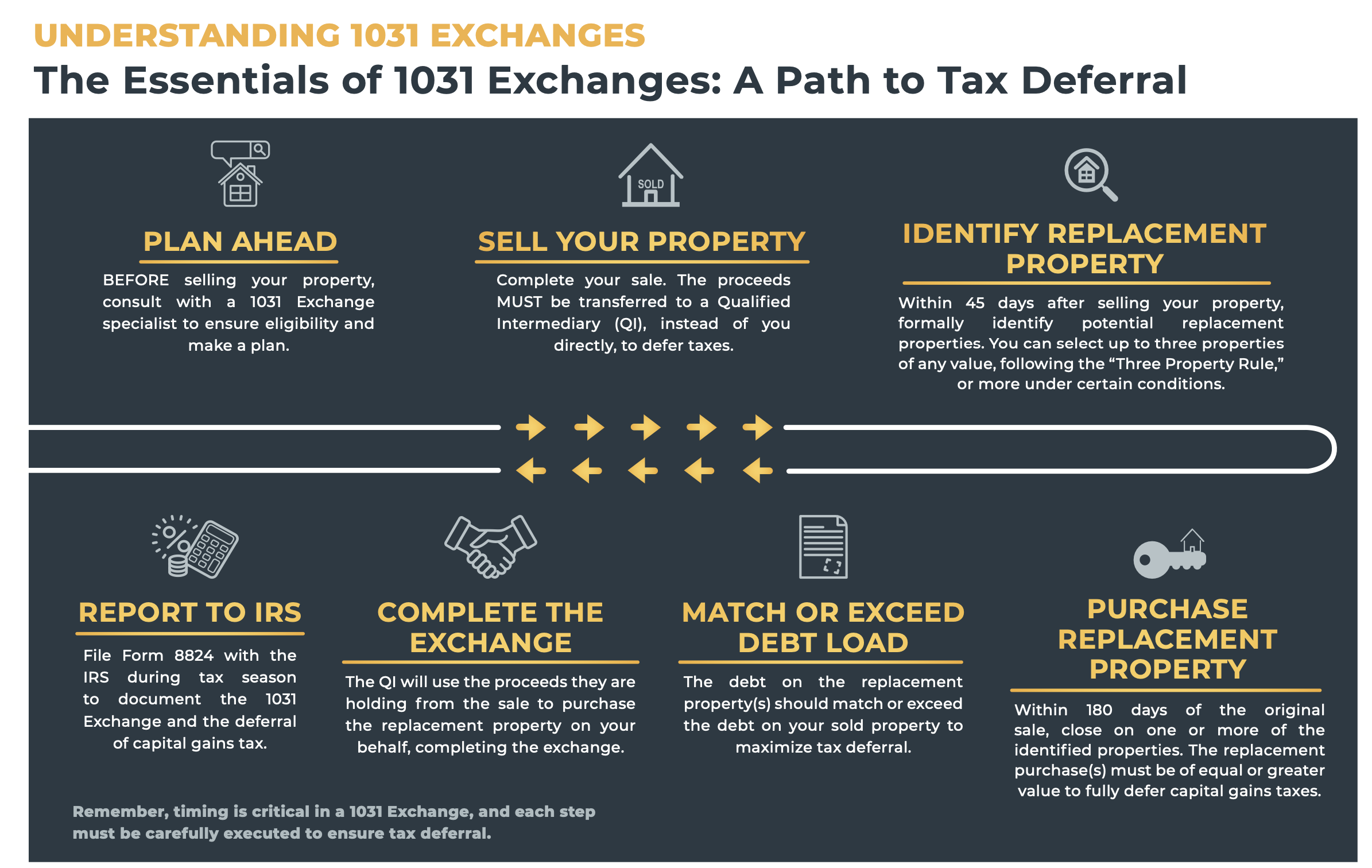

What Is A 1031 Exchange?

In a word; stressful! But, a necessary tool for deferring capital gains taxes, which can be as high as 23.8% in texas, or up to 37.1% in a state with additional taxes, such as california!

A 1031 exchange, named after section 1031 of the U.S. Internal revenue code, presents a powerful tax-deferral strategy for accredited investors engaged in real estate investments. This provision allows investors to defer capital gains taxes on the sale of an investment property, provided that the proceeds are reinvested into another “like-kind” property. The 1031 exchange is a tool for wealth preservation and portfolio growth, enabling more significant investment potential over time.

Accredited investor status opens the door to investment opportunities with potentially higher returns, which are balanced by higher risks and less regulatory protection. These opportunities are not registered with financial regulatory authorities and are not subject to certain disclosure requirements, hence the need for investors to have the financial stability and sophistication to assess and bear the investment risks.

What Makes A 1031 Exchange Difficult and What Are The Alternatives?

Although hundreds of thousands of investors complete exchanges each year, they are not without their share of challenges. Learn more about the challenges and alternatives below.

The Challenges

These include:

- Strict timeframes-puts negotiation pressure on sale prices and purchase prices of replacement properties

Finding the right property - The IRS does not grant extensions on these deadlines.

- 45-day identification period

- You have 45 days from the date you sell your property to identify potential replacement property(ies).

- 180-day closing period

- You have 180 days from the date you sell your property to purchase your replacement property(ies).

Deferring Taxes

The price of the replacement property(ies) must equal or exceed the price of the relinquished property.

The mortgage ratio (leverage) of the replacement property(ies) must equal or exceed the mortgage debt ratio of the relinquished property.

A 1031 exchange is a complex process that requires careful planning and adherence to irs rules and timelines. Accredited investors should work with qualified intermediaries, tax advisors, and real estate professionals to navigate the exchange process successfully.

The Delaware Statutory Trust Alternative

Most are unaware that the 1031 exchange process, with all of its rules and challenging timelines, doesn’t have to result in the purchase of more real estate, which must be actively managed. Instead, the accredited investor can place some, or all, of the proceeds of the sale into a dst, gaining the benefits of income, passive management, and access to institutional-quality real estate. Also, the seller is enabled to diversify their investment dollars across geographies and across many asset classes, such as apartment complexes, corporate headquarters, self-storage facilities, medical parks, etc.

Delaware Statutory Trust Overview

An investment alternative for deferring capital gains taxes in 1031 Exchanges.

A DST represents a flexible, legally recognized trust structure, offering an innovative way for investors to hold fractional ownership in high-quality, income-producing real estate. Established under delaware’s comprehensive statutory framework, DSTs provide a unique blend of benefits designed to cater to the needs of sophisticated investors seeking to diversify their portfolios and potentially defer capital gains taxes.

Key Features of a 1031 Exchange

Benefits of DST Investing Over Traditional Real Estate